The Trump budget is breathtaking in its degree of cruelty and filled with broken promises. Donald Trump promised the American people that he would be a different type of Republican, that he would be a champion of the working American and that he would not cut Social Security, Medicare and Medicaid. But his budget does the exact opposite of what he promised the American people during his campaign.

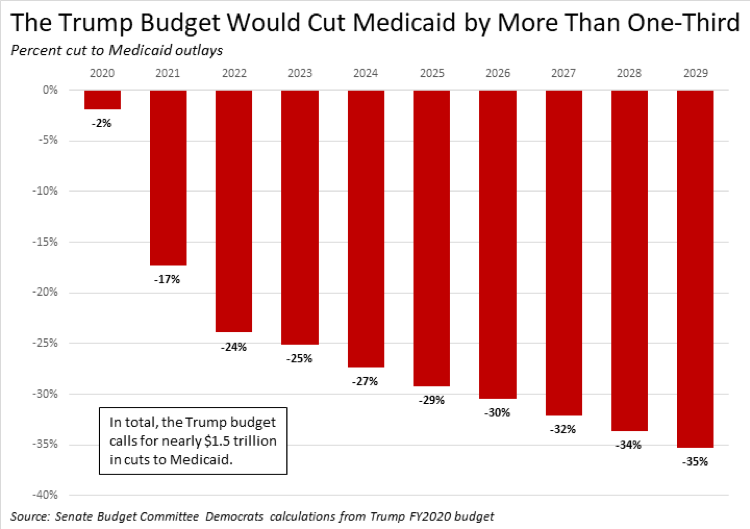

At a time of massive wealth and income inequality, Trump’s budget pays for his huge tax break to the top 1 percent by cutting $1.5 trillion from Medicaid, $845 billion from Medicare and $25 billion from Social Security. Make no mistake about it: Trump’s budget is a massive transfer of wealth from working class families to the wealthiest people and most profitable corporations in America.

At a time when the U.S. already spends more on the military than the next 10 countries combined, Trump is proposing an $861 billion increase in base defense spending over a 10 year period. And he proposes to pay for it by cutting over $1 trillion from education, affordable housing, nutrition assistance and the needs of working families over the next decade. Trump’s proposed increase in base Pentagon spending could make every public college and university in America tuition-free over the next decade.

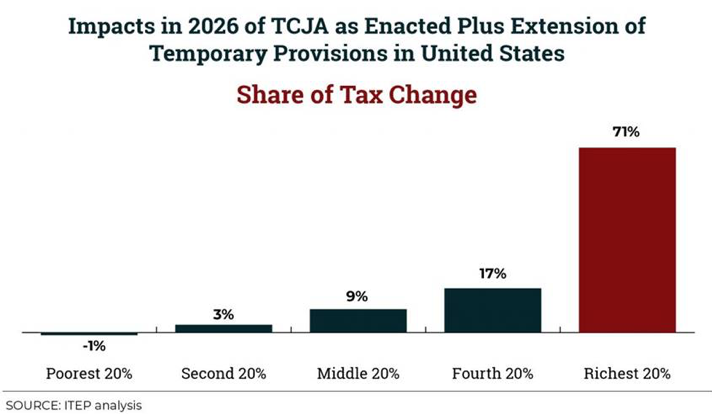

Barely a year after signing into law a nearly $2 trillion, unpaid-for tax cut – in which 83 percent of the benefits would go to the top 1 percent at the end of 10 years – Trump has released a budget that makes devastating cuts to the needs of working families, the elderly, the children, the sick and the poor. The budget doubles down on these tax cuts for the rich by making all of them permanent at a cost of $1.1 trillion over the next 10 years.

The $1.5 trillion Trump proposes to cut from Medicaid – $248 billion in 2029 alone – is enough to eliminate coverage for nearly 30 million people.

Moreover, the Trump Budget would cut $84 billion in programs for people with disabilities, including more than $10 billion from the Social Security Disability Insurance program.

The Trump Budget would cut $220 billion from the Supplemental Nutrition Assistance Program (SNAP, or food stamps), eliminating nutrition assistance for more than 10 million Americans in the budget’s final year.

Meanwhile, the Trump budget proposes that American taxpayers pay $8.6 billion for a border wall on the southern border that he promised Mexico would pay for during the campaign.

This is a budget for the military industrial complex, for corporate CEOs, for Wall Street and for the top one percent. It breaks promises Trump made to the elderly and working families and puts billionaires first. The Trump budget is dead on arrival.

We need a budget that works for all Americans, not just Donald Trump and his billionaire friends at Mar-A-Lago.

What follows are eight of the most egregious proposals in the Trump Budget.

1. The Trump Budget Takes Away Health Insurance from Tens of Millions of Americans

The Trump Budget repeals the Affordable Care Act and slashes Medicaid.

The Trump Budget cuts Medicaid by nearly $1.5 trillion, and repeals the Affordable Care Act Medicaid expansion.

In 2028 alone, Medicaid will be cut by nearly $248 billion, or 35 percent – enough to eliminate coverage for 29 million people, including 5.5 million children and 12 million people with disabilities.

The Trump Budget also phases out $506 billion in Affordable Care Act’s Exchange premium subsidies.

In all, the Trump Budget cuts nearly $2 trillion in programs that help people access the care they need – backfilling $1.2 trillion of this cut with a “Market Based Health Care Grant Program,” a Medicaid block grant, and a per-capita cap on the traditional Medicaid population, explicitly modeled after the disastrous Graham-Cassidy plan that failed to pass the Senate.

The Trump Budget proposes, for the first time ever, mandatory work requirements for Medicaid that would kick 1.7 million people a year off their coverage.

Medicaid covers one in five Americans.

Medicaid covers nearly half of all births in a given state, 38 percent of all children, and 83 percent of poor children.

It covers 48 percent of children with special needs and 45 percent of all non-elderly adults with disabilities.

Medicaid covers 62 percent of nursing home residents and 61 percent of all non-elderly Americans who are living below the federal poverty line.

About 875,000 nonelderly veterans – nearly 1 in 10 veterans ages 19 to 64 – rely on Medicaid.

Medicaid is essential for fighting the opioid epidemic; Medicaid covers 38 percent of non-elderly adults with opioid addiction.

Medicaid covers an estimated 40 percent of people with HIV.

Moreover, the Trump Budget cuts the Medicare budget function by $845 billion over 10 years, including policies that would keep seniors in the Part D coverage gap for longer. The Budget would also cut Medicare hospital funding for graduate medical education and uncompensated care, which could reduce beneficiary access to care.

2. The Trump Budget Takes Food from the Poor and Low-Income Families

The Trump Budget cuts the Supplemental Nutrition Assistance Program (SNAP, or food stamps) by $220 billion over 10 years, eliminating nutrition assistance for more than 10 million people in the final year of the budget.

The administration is replicating its “Harvest Box” proposal from FY19, in which many SNAP recipients, instead of shopping for their own food with this federal benefit, receive a box of non-perishable items, “allowing innovative partnerships with the private sector.”

SNAP is a program for working families and the vulnerable. In fiscal year 2017, 80 percent of all SNAP households included a child, a senior citizen, or a person with a disability. These households received 85 percent of all SNAP benefits.

The budget also cuts the Temporary Assistance for Needy Families (TANF) program by $21 billion over 10 years. The maximum benefit for a family of three with no household income is just $428 in a typical state – a benefit that has fallen in value by one-fourth since 1996.

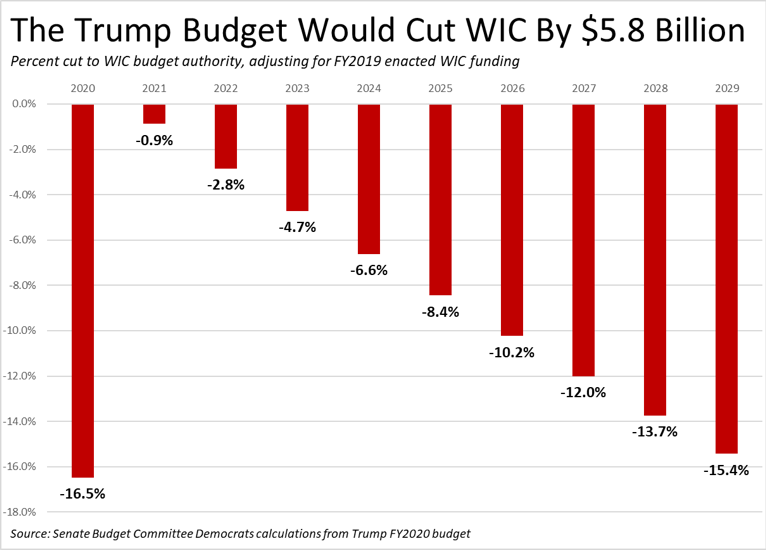

Over 10 years, the Trump Budget cuts $5.8 billion from nutrition assistance for low-income pregnant women, infants, and children (WIC) under the age of five. By flat-funding the WIC program, it will lose enough value to cut more than 1 million women, infants, and children off needed assistance by the final year of the budget.

While these benefits averaged only $40 per person per month, they are vitally important. Studies have shown that this nutrition assistance leads to better birth outcomes, health care savings, improved diet, and better cognitive development.

3. The Trump Budget Slashes Public Health and Programs for People with Disabilities and Illnesses

The Trump Budget cuts programs that benefit people with disabilities by $84 billion over 10 years, including more than $10 billion in cuts to Social Security Disability Insurance – this coming from a President who campaigned on a repeated pledge not to cut Social Security.

Over 10 years, the Trump budget also cuts Supplemental Security Income (SSI) by $3.1 billion by adding work requirements. 1 out of 7 of SSI recipients is a child with a disability.

4. The Trump Budget Slashes Education Spending

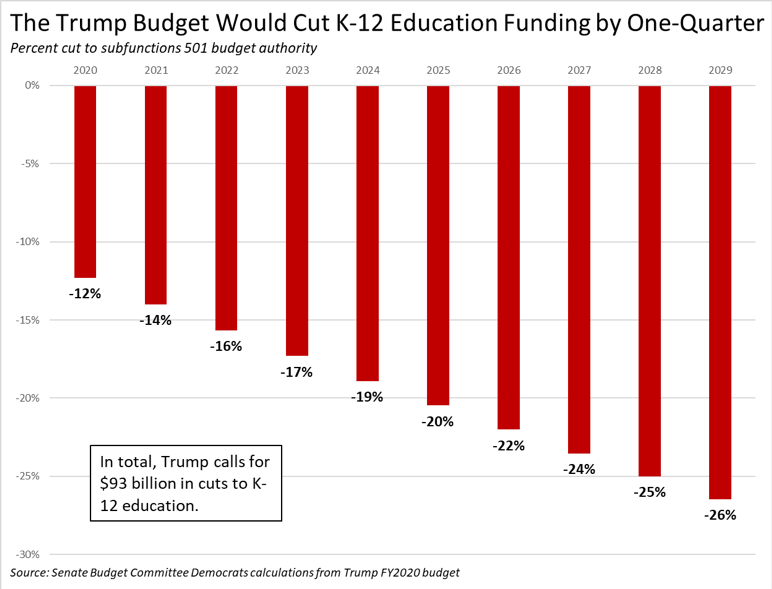

Even as school districts face budgets that are stretched thinner – with some resorting to 4-day school-weeks – the Trump budget exacerbates the problem of under-resourced schools and students.

The Trump Budget eliminates the federally-funded afterschool program, the 21stCentury Community Learning Centers Program. This would throw nearly 2 million children into the streets or leave them home alone instead of in a safe environment for care and learning when the school day ends.

The Trump Budget would cut Head Start by $11.9 billion over the decade; by 2029, Head Start is cut by 18 percent. In the final year of the Trump Budget, more than 150,000 fewer children would lose access to the high-quality childcare and early childhood education Head Start provides.

In all, the Trump Budget cuts K-12 education – programs like Special Education, Education for the Disadvantaged, and School Improvement Programs – by $93 billion over the next 10 years, including a 26 percent cut in the final year of the budget.

5. The Trump Budget Makes College More Expensive

At a time when more than 5 million Americans are in default on their student loans, and the federal government’s student-loan portfolio has reached $1.56 trillion, the Trump Budget makes college even less affordable for students from working families by cutting $207 billion in student financial assistance programs.

The Trump Budget eliminates financial assistance for nearly 1.5 million students by eliminating the Supplemental Educational Opportunity Grant (SEOG) program.

At a time when nearly two-thirds of students must take on debt to get a bachelor’s degree, the Trump Budget completely eliminates the Direct Subsidized Loan program – making college more expensive for the more than 3.2 million borrowers a year that get subsidized loans.

The Trump Budget cuts income-driven loan repayment programs.

The Trump Budget completely eliminates the Public Service Loan Forgiveness (PSLF) Program, taking away the promise of accelerated loan forgiveness for teachers, nurses, firefighters, police officers and other public servants. Nearly 1 million Americans have submitted paperwork to become eligible for PSLF and GAO estimates that 4 million Americans employed in public service fields with student loan debt could be eligible for PSLF.

6. The Trump Budget Slashes Income Security Programs

The Trump Budget cuts $327 billion from the Income Security category. President Trump is constantly reminding us that the economy is doing well for those who make money off of their financial instruments. However, for those who are struggling, their needs are ignored by the Trump Budget.

The Trump Budget eliminates the Housing Trust Fund which in 2008 became the first new federal housing production program in almost three decades, and the first ever designed to build rental housing for extremely low-income households.

The Trump Budget also eliminates the Low Income Heating Assistance Program (LIHEAP).

LIHEAP provided 6.8 million low-income households home heating and cooling assistance in Fiscal Year 2014. The average heating assistance was just $301 per household. When LIHEAP was fully funded at $5.1 billion in FY 2010, the program provided assistance to 8.1 million households.

7. The Trump Budget Cuts Needed Infrastructure Investments

In 2017, the American Society of Civil Engineers gave our country’s infrastructure a D+, saying we need to invest $4.59 trillion over the next 10 years just to get a passing grade. The Trump Budget responds to this acute need with a plan that is mostly non-existent – and in fact, worse than doing nothing at all.

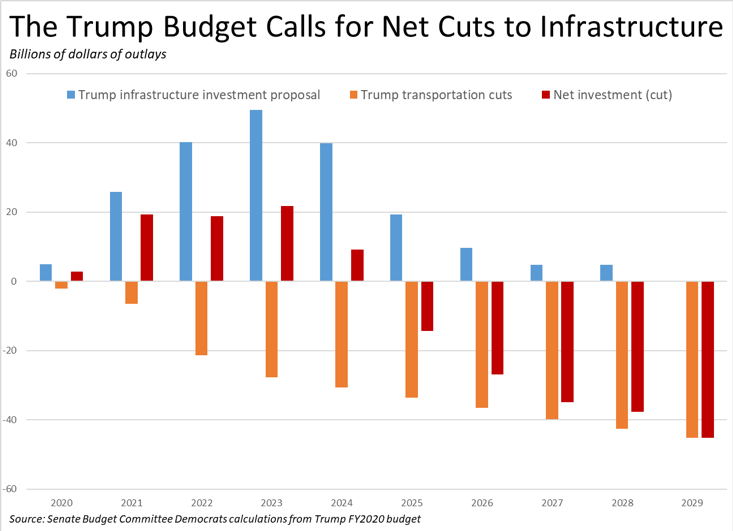

The Trump Budget calls for a $199 billion federal investment in infrastructure projects. However, this is financed with a $286 billion cut to other infrastructure investments and vital transportation programs – a net $87 billion cut to these essential investments.

The Trump Budget cuts $146 billion to the Highway Trust Fund beginning in 2021.

8. The Trump Budget Cuts Domestic Spending by Over $1 Trillion, After Passing a Massive Tax Break for the Wealthy and a Huge Increase for the Pentagon.

In December of 2017, Trump signed into law a tax cut bill that will increase the deficit by nearly $2 trillion, when accounting for interest. In his budget, President Trump also proposes a massive increase in military spending, while slashing domestic spending.

The United States spends more on defense than the next 10 countries combined. Meanwhile, the Department of Defense is the only agency in the Federal government that has never been able to pass an audit. Meanwhile, the Trump Budget increases base defense funding by $861 billion over 10 years.

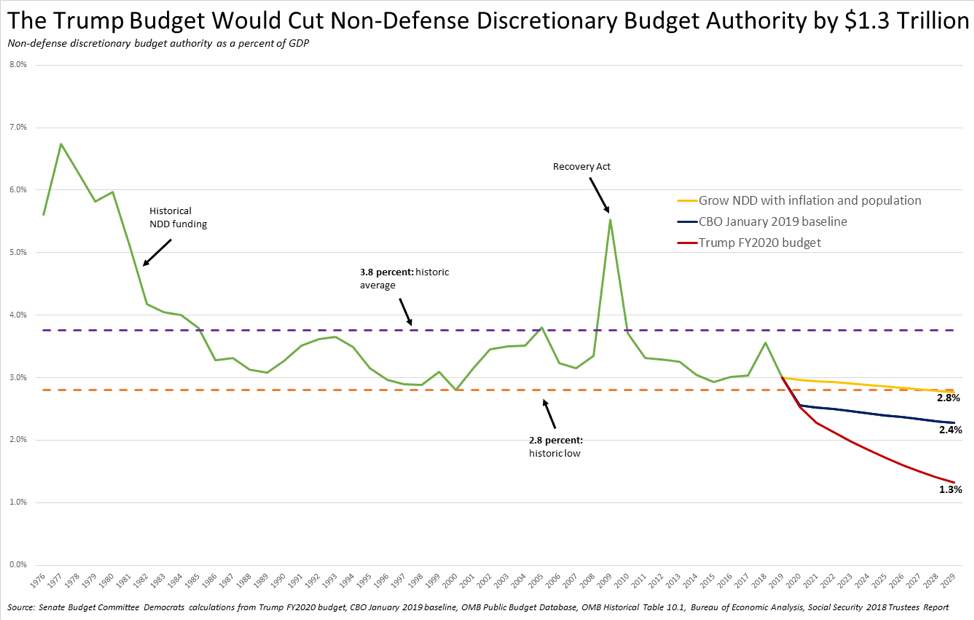

The Trump Budget would also force U.S. taxpayers to pay $8.6 billion to fund a border wall along the southern border that the President promised Mexico would pay for during the campaign. The Trump Budget cuts non-defense discretionary funding by more than $1.3 trillion.

By the tenth year of the Trump Budget, non-defense discretionary spending would represent just 1.5 percent of GDP. The 50-year historical average has been 3.8 percent of GDP, and the lowest level on record was 3.1 percent, in 1999.

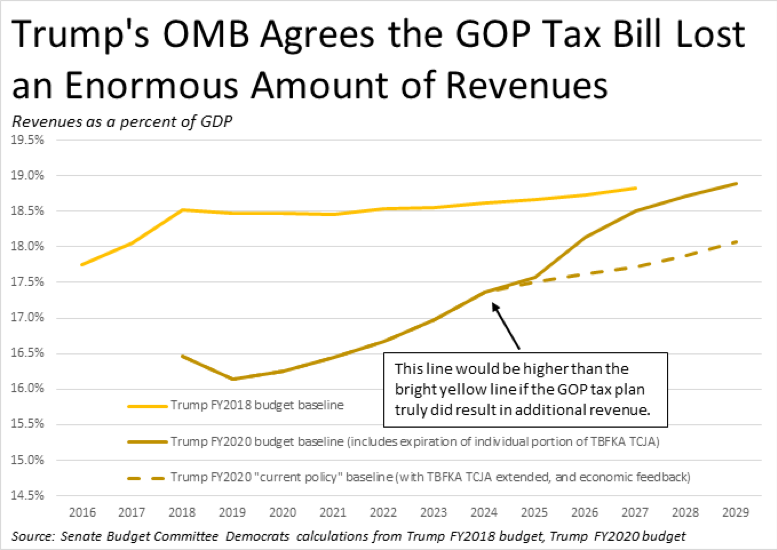

Meanwhile, the Republican tax plan is turning out to be much more expensive than the Administration claimed. Two years ago, the Trump Administration claimed that their tax breaks for the wealthy would pay for themselves and actually lead to more revenue. But now that the tax cuts have taken effect, there has been a massive amount of revenue lost.

Moreover, the Trump Budget would extend these tax cuts through 2029, at a cost of $1.1 trillion. This proposal would provide huge tax breaks to the wealthiest families and largest corporations in America, but do nothing for our most vulnerable.